Bybit Surpasses Coinbase as World’s Second-Largest Crypto Exchange

Bybit cryptocurrency exchange surpassed Coinbase to become the world’s second-largest cryptocurrency exchange by volume after Binance, according to a June report from crypto research firm Kaiko.

The report highlights Bybit’s impressive growth after launching spot Bitcoin ETFs in the US, positioning it as a major player in the global crypto trading ecosystem.

Bybit Overtakes Coinbase in Market Share As Binance’s Dominance Declines

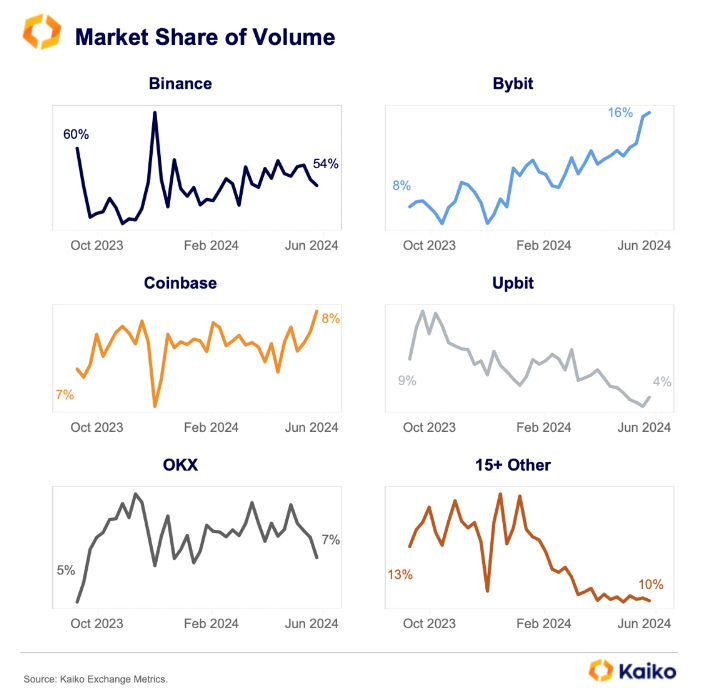

Bybit’s market share has skyrocketed from 8% to 16%, overtaking Coinbase in March to become the second-largest exchange after Binance. While Coinbase has reported improved revenue and profits, its global market share only increased by 1% during the same period.

Additionally, Binance, despite reaching a deal with US regulators in late 2023 to potentially lessen its regulatory risks, saw its dominance slip from 60% to 54%. Smaller offshore markets like Upbit also experienced declines.

According to Kaiko, the driving force behind Bybit’s success seems to be its highly competitive fee structure.

“One explanation could be its competitive fees, among the lowest in the industry,” the report suggests.

Bybit introduced zero fees for USDC trading in February 2023, contributing to its competitive edge.

A deeper analysis of spot trade volumes reveals that Bybit’s surge is largely due to increased Bitcoin (BTC) and Ethereum (ETH) trading. The combined market share of these assets on Bybit has jumped from 17% to 53% over the past year.

In contrast, Binance has seen a decline in BTC and ETH volumes, with their share dropping to 43% this year from 59% a year ago. Instead, Binance has experienced a rise in altcoin trading, which is more susceptible to market volatility and typically declines during bear markets.

Bybit’s ascent in the spot market is complemented by its expanding derivatives offerings. By 2023, Bybit solidified its position as the second-largest derivatives market after Binance. While its share of open interest has been steady since October, Bybit experienced substantial growth in the first half of 2023, possibly benefiting from Binance’s regulatory challenges.

OKX, Binance, and Bybit Monthly Volumes Tripled Since Late 2023

In June 2023, the SEC sued Coinbase and Binance, alleging securities violations. The SEC’s lawsuit against Binance accused the company and its founder, Changpeng Zhao, of misappropriating billions of user funds, although no evidence of such misappropriation was substantiated.

On November 21, 2023, US officials announced a historic $4.3 billion settlement with Binance for Anti-Money Laundering violations, marking one of the largest criminal fines in US history.

According to Bybit’s Institutional Report 2024, global centralized cryptocurrency exchanges (CEXs) trading volumes have greatly increased since late 2023. OKX reported a surge of 278% in 30-day volumes since October 2023, while Binance followed closely with a 239% increase despite the legal issues. Also, Bybit experienced major growth, with a 264% increase in trading volumes.

Coinbase, based in the US, also saw notable growth, with a 193% increase in trading volumes over the same period, slightly trailing the average growth rate of other major exchanges.

Read More:Bybit Surpasses Coinbase as World’s Second-Largest Crypto Exchange