Cronos (CRO) Price Prediction for 2024

Crypto.com, originally founded in 2016 by Kris Marszalek, Rafael Melo, Gary Or, and Bobby Bao under the name “Monaco Technologies GmbH,” has undergone a rebranding and is now known as Cronos. In this article, we will analyze tokens and other factors to project potential price movements in 2024, using data from 2022 and 2023. Before delving into the price analysis, let’s first provide an overview of Crypto.com, now known as Cronos.

This article may be outdated, we suggest you visit our new Cronos Price Prediction tool.

Crypto.com is a trading platform that offers financial services. The native token for the firm is Crypto.com Coin (CRO). As of December 2023, CRO has been rebranded to Cronos in a bid to accelerate the global adoption of services offered by Crypto.com.

One of the most significant new developments for the firm is the Crypto.com chain, whose CRO is the native token. It is an open-source blockchain that is associated with low fees and high transaction speeds. It aims to increase blockchain adoption through services like regular payments, decentralized finance (DeFi), and an NFT marketplace.

Another interesting product is the crypto.com card, which is compatible with both fiat and crypto tokens. It has a 20% buyback plan when making payments in CRO and a 10% plan for purchasing gift cards.

The company is continuously searching for new ways to speed up the process of blockchain adoption in order to allow users to be more in control of their own finances and data.

Did you know? Crypto.com was one of the first crypto platforms to bring home the concept of a metal-clad Visa card with crypto links. The cashback for the same is/was credited as Cronos (CRO) tokens.

Tokenomics

When the CRO Mainnet launched in March 2021, 70 billion tokens were burnt, making it the largest burn in history. Since then, it has not been possible to mine any more CRO tokens, leaving the maximum supply at 30,263 billion tokens.

The token is allocated into five main categories:

- 30% – Secondary distribution, released in regular batches

- 20% – Capital reserve (unfrozen on Nov 7, 2022)

- 20% – Long-term incentives for the network (unfrozen on Nov 7, 2022)

- 10% – Community development

- 20% – Grants for the ecosystem

Holders can also stake CRO and earn rewards for helping process transactions on the network since CRO is used for settling transactions. As of December 2023, 83.48% of the total supply is in circulation.

“$FTM is the only chain in the top 10 (apart from Cronos) to increase its TVL in the past month.”

Miles Deutscher, Crypto Analyst: On X in 2022

Also, here is what the entire Cronos ecosystem looks like:

CRO price prediction

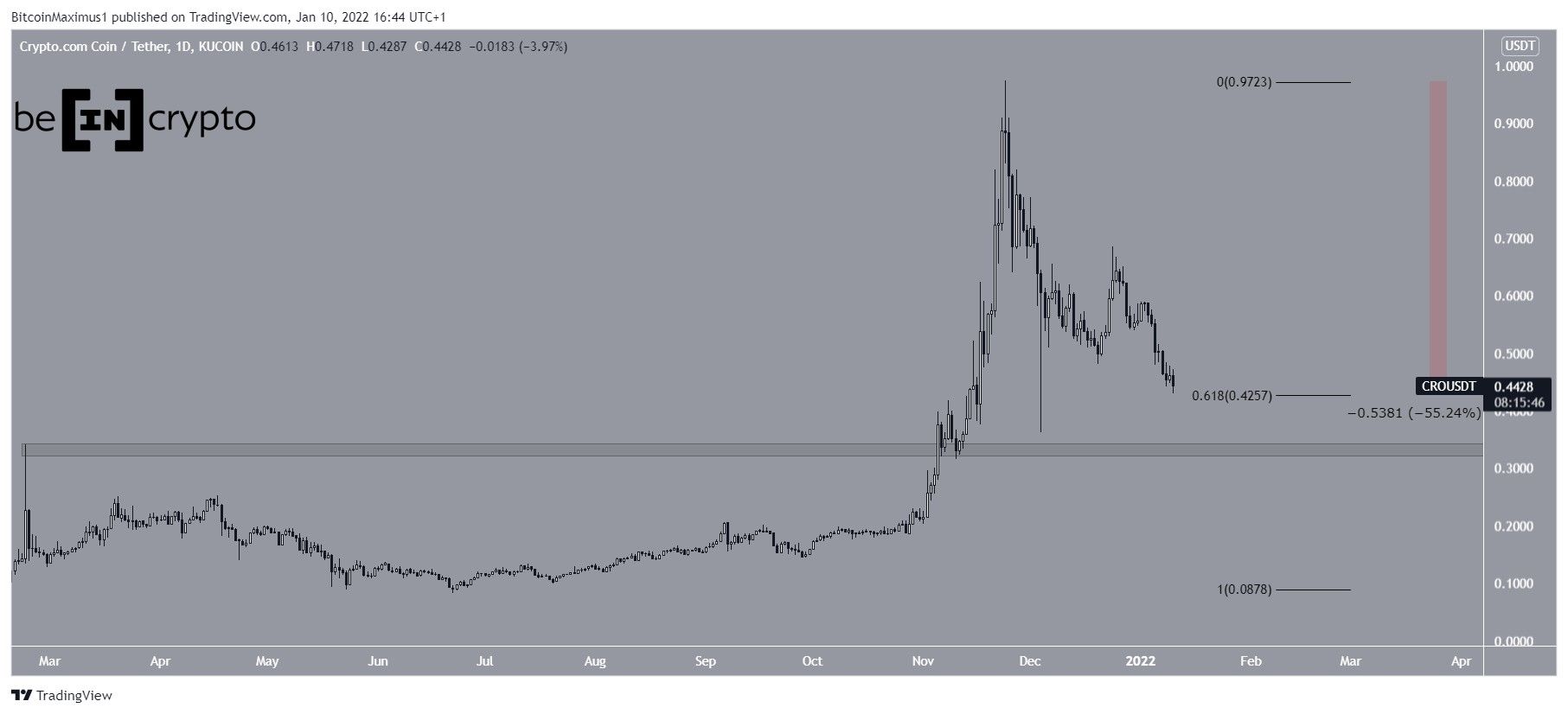

CRO’s price has been falling since reaching an all-time high of $0.97 on Nov. 24, 2021. So far, it has decreased by almost 90%. Let us now retrace the steps of our first analysis, which happened in early January 2022. It will help us determine crucial support and resistance levels.

It is currently trading just above the 0.618 Fib retracement support level at $0.425 (important resistance now). Therefore, it is possible that the current level will initiate a bounce.

If not, there is very strong horizontal support at $0.32, created by the previous all-time high region. Therefore, it would be likely for CRO to bounce at one of these support levels, temporarily halting the decrease.

Notably, CRO broke each of the mentioned support levels even to break the $0.1 mark and drop as low as $0.5 in 2023.

CRO price prediction 2022

Before diving into the 2024 analysis, let’s look at CRO’s performance in 2022. CRO initiated an upward movement of five waves at the beginning of 2021. It is in the fourth wave of this overall pattern, with a projected conclusion of $0.32 to $0.42.

Wave three was the most extensive, reaching the 4.618 external Fibonacci retracement level. Consequently, wave five will probably be similar in length to wave one, representing a 100% increase. Considering a starting point from the potential support’s lower end, a 600% rise would take CRO to $2.23. However, this scenario didn’t materialize due to weaker adoption cycles.

Cronos price prediction 2024

Now that we know how the prices moved in 2021 and 2022, it is time to open the latest chart, as of December 2023, to analyze CRO’s future moves.

The daily chart reveals something interesting. CRO is trading inside an ascending wedge, which could be bullish if there is enough volume to increase prices. However, a short-term correction might be imminent as the RSI is making lower highs and showing weakening momentum.

However, if the bull market appears and pushes the RSI higher than the last high, CRO might see some upside. In case you are looking at 2024 as the deciding year, there could be highs of $0.155 waiting, provided the first resistance — $0.1183 is crossed with high volume.

Will $1 be a realistic target for CRO?

The CRO token is currently undergoing a retracement, and to surpass the $1 mark, it would need to return to its 2021-22 levels. However, this outcome is still being determined. The initial target to achieve is $0.4, which we anticipate happening around 2025 or 2026.

If CRO can make the most of its extensive public exposure, it may expedite its growth and potentially rebound from its support levels.

Frequently asked questions

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read More:Cronos (CRO) Price Prediction for 2024