Core Scientific Aligns With Macroeconomic Trends But Too Highly Valued (NASDAQ:XPDI)

PM Images/DigitalVision via Getty Images

Introduction

Although Core Scientific (XPDI) has been quiet in the past two months, the economic conditions and Bitcoin (BTC-USD) are experiencing tremendous volatility. It is only recently that we discovered the relationship between valuation, profitability, market cap, and stock performance. Here is the summary of our findings:

- Only profitable companies or funds with almost 100% profitable holdings earn positive returns.

- Larger-cap stocks or funds consistently outperform smaller-cap funds.

- Lower valuation stocks tend to outperform larger valuation stocks.

You can refer to Table 1 for further reference.

At first glance, you might immediately think of Core Scientific as it is considered to be one of the largest, if not the largest, crypto hosting providers and Bitcoin miners in the industry. It has an expected 32 EH/s capacity (including both hosting and self-mining) and is valued at $4.7bn at the time of writing.

Therefore, this article aims to add clarity to constructing your investment thesis in this manner.

Table 1: Summary table of fund performance.

| ETF | Weighted PSR | Weighted PER | % Profitable Distribution | Weighted Market Cap | YTD Performance |

| VUG | 7.015 | 36.7 | 100% | $346bn | 25.7% |

| SPY | 2.69 | 22.17 | 100% | >$650bn | 18% |

| VBK | 4.44 | 31.2 | 90% | $6.8bn | 3% |

| ARKX | 9.35 | 24.2 | 55% | $121bn | -6% |

| ARKQ | 13.7 | 78 | 67% | $153bn | -3% |

| ARKW | 17.8 | 98 | 67% | $188bn | -11.5% |

| ARKK | 16.8 | 75.6 | 44% | $153bn | -13% |

| ARKF | 21 | 108 | 55% | $41bn | -16.4% |

| ARKG | 22 | 35.7 | 20% | $14bn | -23.9% |

| BIGZ | 21 | 35.5 | 50% | $10.8bn | -26.4% |

Source: Author

Bigger is Better, at least in terms of Resilience against Uncertainty

The divergence between large cap and small cap is caused by the perceived higher risk level of small-cap stocks in highly uncertain economic conditions. Smaller-cap companies, in general, are less resilient to disruption than larger-cap companies. Smaller-cap companies have a smaller balance sheet or access to capital. They have less diversified sources of revenue.

This is indeed true also for crypto mining companies. Here, we compare Core Scientific to two of our current favorite crypto mining companies (Bitfarms (BITF) and Stronghold Digital Mining (SDIG)):

- In terms of market cap, Core Scientific is four times and 20 times larger than both SDIG and BITF, respectively.

- In terms of expected built-up mining capacity in 2022, Core scientific is four times larger than both SDIG and BITF.

- In terms of power supply, Core Scientific’s five facilities across North America with a combined 825 power supply are five times larger than SDIG and 2.5 times larger than BITF.

- In terms of funds for sustainability and expansion, Core Scientific has $450mil in total liquidity ($310mil in cash and 2,800 Bitcoins each at $50,000), while BITF and SDIG have $191.65mil (=$43mil cash + 2973 Bitcoins each at $50,000) and $136.5mil (=$132.5mil cash + 85 Bitcoins each at $50,000) total liquidity respectively.

- In terms of cost, Core Scientific’s cost of power per Bitcoin is $2.7k, while BITF and SDIG’s stand at $6.9k and unknown, respectively.

Based on these insights, we can see the appeal of investing in a larger-cap crypto mining company, given the current Omicron-induced uncertainty and inflationary environment. Core Scientific has the lowest breakeven mining cost, the most liquidity, and the largest facilities. This makes it the most resilient among the three companies.

Another aspect where Core Scientific is less risky than BITF is the hosting service. The main difference between revenue from self-mining and hosting is that the revenue from hosting doesn’t benefit from the rise in Bitcoin price. The revenue from hosting is a function of maximum power supply (MW), hosting rate, uptime, and power usage effectiveness (PUE). In this respect, Core Scientific is more resilient than BITF during a severe Bitcoin drawdown.

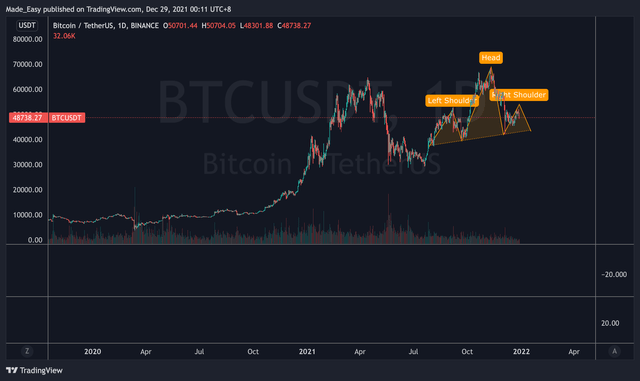

Moreover, a massive potential head-and-shoulders pattern is flashing in Bitcoin’s daily chart. If this bearish pattern follows through, there’s a high probability that Bitcoin will turn bearish and resume its bear market dictated by its halving cycle. Hence, investors might prefer the larger-cap Core Scientific over small-cap BITF and SDIG.

Figure 1: Potential Massive Head-and-Shoulders Pattern on Bitcoin Charts

Source: Author, Trading View

Don’t Overpay a Good Company

As good as Core Scientific may be, our model suggests that Core Scientific is too highly valued. In our previous coverage, our model valued Core Scientific at $12 per share or $4.7bn under the assumption of a $66,000 Bitcoin. Now that Bitcoin is struggling to break above the $50,000 mark, we had to revise our price targets for Core Scientific accordingly.

Following the methodology and assumption (with slight revision: 270 EH/s Bitcoin Network Hash Rate) presented in our previous coverage, our model values Core Scientific between 2.14bn (-55%) to 3.21bn (-32%) based on a $50,000 Bitcoin Price. That’s being said, Core Scientific’s downside is rather limited thanks to its $10 NAV.

Using the same methodology, our model suggests a 25% upside for BITF and a 345%-946% upside for SDIG. There are several ways to interpret these results.

Firstly, due to the current divergence between large-cap and small-cap companies, valuations of small-cap companies were crushed to a point where such substantial upside is available. For instance, both BITF and SDIG have a similar built-up expectation of 8 EH/s by the end of 2022. SDIG is priced at only one-fifth of BITF.

Secondly, perhaps the safety of larger crypto mining companies (more so the $10 NAV protection Core Scientific currently offers) is so desirable that investors are willing to pay a premium for it.

Nevertheless, we’ll abide by our conviction reflected by our model’s price targets for Core Scientific and not overpay for a good company. On the other hand, although the current economic trend isn’t favorable for small-cap companies such as SDIG, and SDIG could see further downside, its upside is too good to ignore.

Verdict and Conclusion

Macroeconomic trends caused a divergence between large-cap and small-cap companies where small-cap companies fell out of favor due to higher associated risk amid Omicron-induced uncertainty and an inflationary environment. Perhaps the demand for safety drove safer (larger-cap) companies higher such that upside becomes limited or overvalued entirely. Combined with Bitcoin’s drawdown from $66,000, this could be the case for Core Scientific.

Although macroeconomic trends favor Core Scientific over BITF and SDIG, we prefer BITF and SDIG simply due to their valuations.

Read More:Core Scientific Aligns With Macroeconomic Trends But Too Highly Valued (NASDAQ:XPDI)