Dimon’s muted response to the bitcoin ETF approval prompts industry debates about JPM’s

The curtains closed on the 2024 World Economic Forum (WEF) in Davos on January 19, which saw conversations moving away from the crypto-centric dialogues dominating the past year, now centering on the current exploration of Generative AI (Gen AI).

While Gen AI remained the primary focus of discussions with companies prioritizing its accuracy in the tech model as a central theme, attention also shifted to bitcoin after the SEC approved US-listed ETFs. This development has sparked renewed interest and conversation surrounding cryptocurrency within the broader conversation.

Crypto proponents

The regulatory nod marks a significant milestone in the integration of cryptocurrency into capital markets. Among other things, this decision also acted as a catalyst for the transformation of the Grayscale Bitcoin Trust, holding around $29 billion in cryptocurrency, into a full-fledged ETF. Additionally, it opened the gates for the introduction of competing funds from major players in the financial sector, including BlackRock’s iShares and Fidelity.

Crypto advocates are optimistic that the advent of bitcoin ETFs will likely propel a surge in demand for the asset class and attract a diverse array of investors who had previously been hesitant due to lingering concerns about custody practices and the safety of crypto exchanges.

“If we see the likes of BlackRock and Fidelity launch Bitcoin ETFs, we can expect a lot of other traditional financial institutions to enter the crypto markets as well,” said Henrik Andersson, chief investment officer at Apollo Crypto following the SEC’s announcement.

In the wake of approval, crypto ETFs recorded a trading volume of $4.6 billion in shares the following day. Grayscale, BlackRock, and Fidelity led the charge in trading volumes in a competition to capture greater market share, as a section of investors embraced the new opportunity.

The naysayers

Still, it’s too early to determine the full impact of this decision on the broader cryptocurrency market. Some analysts believe the jubilation around the announcement may be hasty.

“We are skeptical of the optimism shared by many market participants at the moment that a lot of fresh capital will enter the crypto space as a result of the spot bitcoin ETF approval,” said a team of analysts of Nikolaos Panigirtzoglou, managing director of Global Market Strategy including Alternatives and Digital Assets at JPMorgan.

Expanding on this narrative, Todd Rosenbluth, strategist at VettaFi said, “Trading volumes have been relatively strong for new ETF products. But this is a longer race than just a single day’s trading.”

The broader investment community still maintains a skeptical outlook toward cryptocurrencies and associated investment products, deeming them high-risk assets. The skepticism is rooted in the previous year’s crypto market contraction, triggered by the collapse of FTX and other major players, prompting regulatory actions to scrutinize the resilience of crypto investments.

Addressing the concerns harbored by investors on Thursday at the WEF in Davos, Grayscale CEO, Michael Sonnenshein said, “Investors are weighing heavily things like liquidity and track record and who the actual issuer is behind the product.”

Undeterred by recent developments, JPMorgan Chase CEO Jamie Dimon maintained his longstanding skepticism toward bitcoin, expressing little change in perspective.

When asked about the SEC decision’s impact on the largest US bank by assets, Dimon’s response took on a rather questioning undertone, dialing back the wider enthusiasm linked to the news during an interview at the same event.

“Imagine, if you’re a client, you could call and say get me some of this ETF. What do you tell your brokers to tell them back when they make the call?” asked Dimon.

Dimon supports the adoption of blockchain technology and tokenization, which involves the use of crypto tokens that facilitate transactions on blockchain networks and can be employed for various purposes, such as the purchase or sale of real estate or moving data. Beyond this, he clings to a dissenting opinion about bitcoin, referring to it as a ‘pet rock’ devoid of any meaningful utility. He further critiqued bitcoin’s prevalent use cases, highlighting its association with fraudulent activities, money laundering, tax avoidance, and its alleged involvement in shady dealings like sex trafficking.

“My personal advice is don’t get involved [in bitcoin] but I don’t want to tell anyone what to do, it’s a free country,” he said. “This is the last time I’m ever stating my opinion [regarding bitcoin].”

Dimon has a history of making bold statements regarding bitcoin, and this recent instance is no exception. In December, he didn’t mince words as he openly recommended the outright ban of cryptocurrencies at Capitol Hill, emphasizing the need to apply identical anti-money laundering regulations on crypto companies as major financial institutions.

Dimon’s recent remarks about Bitcoin have drawn new criticism toward his own and the bank’s position. Crypto advocates are now questioning JPMorgan’s role as one of the authorized participants for BlackRock’s new bitcoin ETF, where the bank facilitates capital movement in and out of the fund.

Additionally, Dimon’s connection of bitcoin’s applications to illicit activities has triggered a further backlash and resurfaced past questions, particularly, in light of the two lawsuits against the firm, accusing it of complicity in the sex trafficking activities of its long-time customer Jeffrey Epstein. Despite the bank’s denial of any wrongdoing, it incurred nearly $14 million in legal fees defending itself in September. The firm also settled the first lawsuit in July 2023, by agreeing to pay $290 million to Epstein’s victims.

The market continues to be volatile…

The industry seems to be experiencing a persistent divide — amid the inherent uncertainty in this field, investors are leaning toward a positive outlook. Many are expressing an interest in integrating cryptocurrencies into their future portfolios, especially as global discussions on regulation have begun to take center stage.

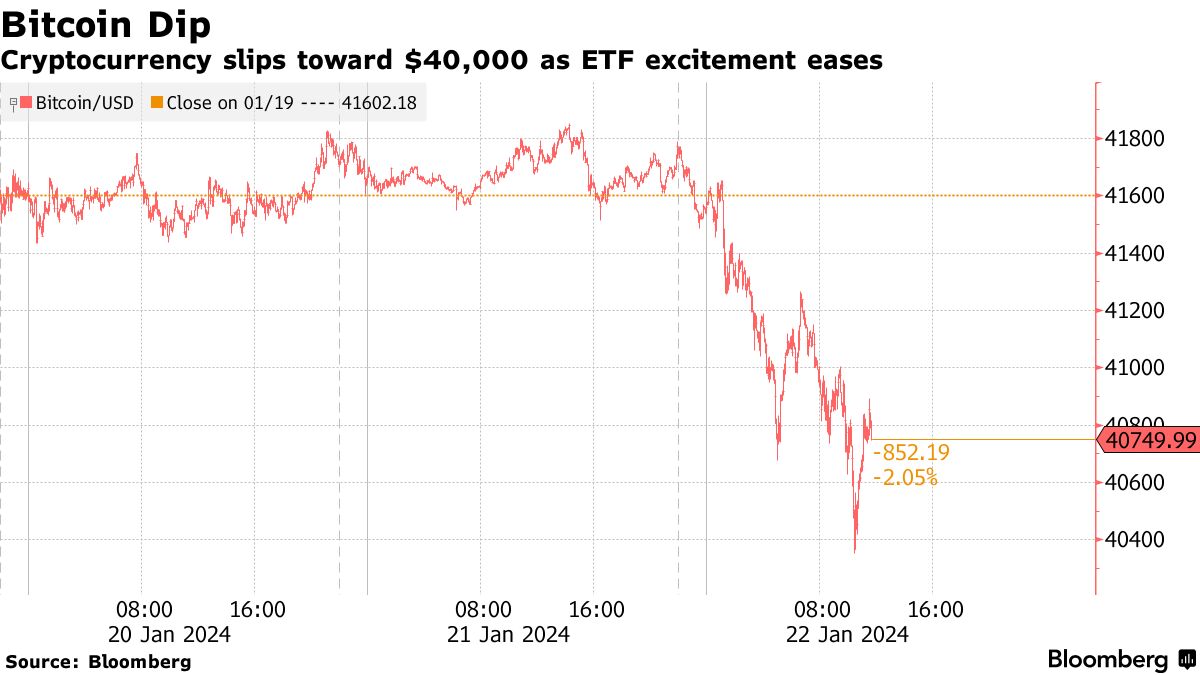

However, the market remains unpredictable. The price of bitcoin has dipped by over 10% since the recent introduction of spot bitcoin ETFs and declined as much as 3.4% on Monday morning indicating investors adopting a wait-and-see approach.

“It appears that profit taking i.e. buy the rumor/sell the fact dynamics took place in recent days,” said Panigirtzoglou in his LinkedIn post. “Most of this inflow reflects a rotation from existing bitcoin vehicles such as futures-based bitcoin ETFs which show outflows of close to $300 million since last Thursday, or from retail investors shifting from digital wallets held with exchanges/retail brokers to cheaper spot bitcoin ETFs.”

Analysts anticipate the pullback to be a result of diminishing excitement over the news. Furthermore, they project a further decline in Bitcoin’s value due to the industry’s inherent volatile nature, while affirming its long-term upward trajectory.

Read More:Dimon’s muted response to the bitcoin ETF approval prompts industry debates about JPM’s